ABOUT US

South African VAT rules and laws are scattered throughout statutes, binding general rulings, regulations, notices and court judgments and in addition has features unique to South Africa. For the layman, trying to understand and apply the South African VAT rules can be very taxing and, often, in our experience, may turn out to be very costly. Finding quality advice to guide you through the regulatory South African VAT landscape may be difficult. Large law and accounting firms are extremely expensive and turnaround times are seldom what you need them to be. Smaller firms often lack the ability to deal with complex legal issues that often arise in applying the South African VAT rules and laws to practical problems.

While we are not a law firm nor an audit or accounting firm, our team consists not only of highly qualified and experienced tax professionals but also of lawyers and chartered accountants with roots embedded in some of the largest tax service firms in South Africa. We are a niche South African VAT consulting firm.

Our experience, expertise and background allow us to provide VAT advice of same and often better quality and within faster times than some of the larger firms. Our professional rates are however much more affordable. We also follow a practical approach to find constructive solutions that add tangible value to your business and which fall well within what the law allows and prescribes.

VAT REFUNDS

Our expertise and experience as admitted attorneys have allowed us to understand that there is a trend with SARS with regard to how they approach VAT refunds. As a result thereof, we also understand the most effective way in which to speed up the process and avoid unnecessary delays.

Many compliant taxpayers feel that they are mistreated on their VAT refunds, and for most of them, rightly so. This may be partly due to the perfect storm of a shrinking economy, administrative delays and perceived deliberate delays when SARS owes you money. These ever-increasing complaints and the many theories surrounding the delays has even led to the Tax Ombud issuing a rather damning report on the topic.

Our expertise and experience as admitted attorneys have allowed us to understand that there is a trend with SARS with regard to how they approach VAT refunds. As a result thereof, we also understand the most effective way in which to speed up the process and avoid unnecessary delays. Through many engagements with SARS, with which we have assisted many of our high net worth clients, we have developed a strong and effective approach to this ever-growing issue.

PUBLIC BENEFIT ORGANISATIONS

Are you as organised as you think?

On occasion, we are privileged enough to deal with organisations that truly do some good in the world. Those that give their time and resources for the benefit of others. All for no personal gain, profit or recognition. Public Benefit Organisations (“PBO”) are champions of humanity in a world of those stepping over the down-trodden.

Thing is, the good intentions of PBO’s are often thwarted by the actions of others, whether through lack of interest or administrative difficulties.

IMPORTS AND EXPORTS

This is an area of tax, particularly within the realm of VAT, that is inexplicable when it comes to SARS’ treatment thereof, the consequences of which can be extremely bothersome for many taxpayers. For SARS, it does not seem to be enough for taxpayers to be fully compliant in order for them to receive their duly entitled refunds. Taxpayers need to go over and above SARS’ requirements and any minor error can be the reason for the refusal of such refund.

LOCAL AND INTERNATIONAL VAT

South African Business

As a South African business, you are well aware of your South African VAT obligations. VAT however is often processed as part of the accounting function of your business with issues being identified much later than when they arose. This is typically when an IT14SD is requested by SARS or when raised by external auditors. VAT can and should be managed proactively, much like corporate income tax.

Foreign Business

Our professional team not only has a deep understanding of South African VAT rules and laws but also has the experience to deal with real problems and practical issues associated with South African VAT. Our approach is not to only define a problem but also, to find practical solutions to them. Conducting operations in South Africa, like with most foreign countries, comes with uncertainty and risk. Our area of expertise will help you mitigate at least the VAT risks associated with conducting business in or through South Africa.

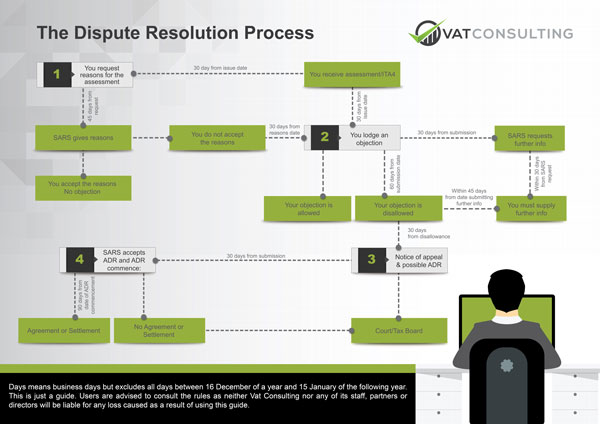

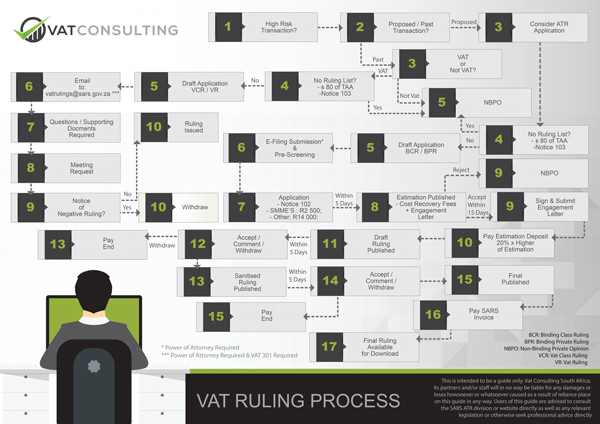

VAT PROCEDURES

PROFESSIONAL MEMBERS